- Promotions

- Loan Repayment

- About Us

- FAQ

- Guide

24/7 - acceptance of applications

0% for the first loan

We guarantee the security of your data and cooperate with the top partners

Get a loan in 15 minutes

Giving everyone up to LKR 100,000 for any purpose

Registration in 10 minutes

A simple loan

For service without additional conditions and commissions

0% new loan

Minimum documents

Need only ID number

Flexible loan

independent choice of the required amount

-

for a repeat credit - from 5,000

to 100,000 LKR -

for a new loan - from 5,000

to 50,000 LKR

Payday loan

We give credit for 5 to 30 days

Reliable service

We guarantee the confidentiality and protection of your data

Prolong the loan at any time

All operations on the loan in the personal account

Just 3 registration steps

Fill out the application form

Complete registration documents as instructed

Wait for review results

Get the results of the review the same day after completing the applicationReceive a loan

Get money into your bank accountFlexible loan term

We give the opportunity to prolong the loan period

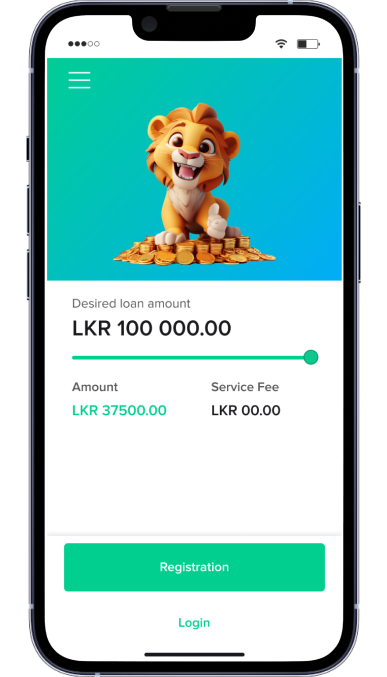

From: Rs. 5,000

To: Rs. 50,000

Interest rate from 0% to 16%

Example of the first loan: You apply for Rs. 5,000.00 / - and pay in full after 121 days of using the loan. Service fee is 0 / month.

Total amount to be settled Rs. 5,000.00 / -

Example for a Repeat loan: You apply for Rs. 5,000.00 / - and pay in full after 121 days of using the loan. Payment 2867 / month.

Total amount to be settled Rs. 8,600 / -

Our products

For Health

Unexpected problems in your health for you or your loved ones? Incase of an emergency we are ready to help you in instantly

Business Needs

Falling short of working capital? We will partner with you in helping you fund your business needs

To pay bills

Falling short of money in hand to pay bills in the end of the month? We are here for you

Student Loans

Having trouble in affording to pay for school or class fees? We have a convenient solution in offering loans for all the people seeking emergency funds for education

Salary Advance

Weeks away from your paycheck? Worry no more, apply for a loan from us, and get a salary advance before your pay day.

For Health

Unexpected problems in your health for you or your loved ones? Incase of an emergency we are ready to help you in instantly

Business Needs

Falling short of working capital? We will partner with you in helping you fund your business needs

To pay bills

Falling short of money in hand to pay bills in the end of the month? We are here for you

Student Loans

Having trouble in affording to pay for school or class fees? We have a convenient solution in offering loans for all the people seeking emergency funds for education

Salary Advance

Weeks away from your paycheck? Worry no more, apply for a loan from us, and get a salary advance before your pay day.

For Health

Unexpected problems in your health for you or your loved ones? Incase of an emergency we are ready to help you in instantly

Download the app and get a discount OnCredit

If you are a frequent customer of the instant loan facilities offered by OnCredit, downloading the OnCredit mobile app makes more sense than accessing the website through a mobile web browser like Google Chrome or Firefox.Download the app and get a discount OnCredit

If you are a frequent customer of the instant loan facilities offered by OnCredit, downloading the OnCredit mobile app makes more sense than accessing the website through a mobile web browser like Google Chrome or Firefox.Our Partners

Testimonials

Nayani Fernando

5.0 facebook rating

I was finding it very hard to manage paying bills in the end of each month, having service providers like OnCredit helped me ease my worries as their service is instant and it was easy for me to manage my expenses every month

Azeem Abdu

5.0 facebook rating

In many instances i have borrowed funds from OnCredit, because my business is as such that i always fall short on working capital. I’m very thankful for the services offered to me, not to mention the convenience of obtaining a repeat loan.

Celestine George

5.0 facebook rating

I would never forget the time when OnCredit helped me during an emergency. I had fallen short of cash to pay for my mothers medical treatments, if not for OnCredit i would be in big trouble right now. Thank you so much!

Janitha Perera

5.0 facebook rating

I'm so thankful for OnCredit, as I was falling short of money in hand mid-month. OnCredit helped me with a salary advance, the application and approval process was so easy.

Nayani Fernando

5.0 facebook rating

I was finding it very hard to manage paying bills in the end of each month, having service providers like OnCredit helped me ease my worries as their service is instant and it was easy for me to manage my expenses every month

Azeem Abdu

5.0 facebook rating

In many instances i have borrowed funds from OnCredit, because my business is as such that i always fall short on working capital. I’m very thankful for the services offered to me, not to mention the convenience of obtaining a repeat loan.

Celestine George

5.0 facebook rating

I would never forget the time when OnCredit helped me during an emergency. I had fallen short of cash to pay for my mothers medical treatments, if not for OnCredit i would be in big trouble right now. Thank you so much!

Janitha Perera

5.0 facebook rating

I'm so thankful for OnCredit, as I was falling short of money in hand mid-month. OnCredit helped me with a salary advance, the application and approval process was so easy.

Nayani Fernando

5.0 facebook rating

I was finding it very hard to manage paying bills in the end of each month, having service providers like OnCredit helped me ease my worries as their service is instant and it was easy for me to manage my expenses every month

Azeem Abdu

5.0 facebook rating

In many instances i have borrowed funds from OnCredit, because my business is as such that i always fall short on working capital. I’m very thankful for the services offered to me, not to mention the convenience of obtaining a repeat loan.

Play the game and enjoy the additional discount up to 60%

We created a game so you can take more possibilities to win personal discounts

Online loan at a low interest rate, get money in 30 minutes after registration

Do you urgently need money, but your bank account, wallet, and stocking hid under the bed are empty? First of all, in such moments, we turn to family and close friends, but they cannot always lend a helping hand. Good way to get the missing money quickly is online loans. Read the article and find out about loans on the Internet: what it is, how to get it, and other interesting facts.

Most often, online loans are offered by lenders of the non-banking sector, but often banks also allow customers to fill out an application, for example, for a consumer loan, in online form. However, in this case, documents need to be drawn up on the spot in any branch of the bank.

Alternative forms of finance, such as microcredit, are now becoming a useful tool for operational support for small and medium-sized enterprises. In addition, they provide opportunities for individuals without access to traditional forms of financing (bank lending). Online credits, according to current data in the country, refer to cash loans online up to Rs 50,000, with a base interest rate.

For Sri Lanka, unlike other Asian countries, the lenders are banking institutions (a huge share of which belongs to cooperative banks). The introduction of a special institutional framework by the Ministry of Economy and Development is in the final stages of preparation and envisages the establishment of a Microcredit Fund to be financed by specialized companies (microcredit providers) supervised by the Bank of Sri Lanka. At this stage, these organizations are limited to simple mediation services (advice, information, collection of supporting documents, etc.).

According to statistics, the main reason why people apply for personal loans is to cover daily expenses. According to the OnCredit study, about a third of applicants (34%) for quick credit cites household expenses as a reason to borrow. In Sri Lanka, as in the rest of the world, the quick-credit or cash lending service of financial companies has proliferated. There are even online comparison services for various loan, mini-credit, and cash lending companies where you can select a lender using filters and feedback. Many people simply overwhelm, thus consolidating debt, this is the second most frequent cause of rapid borrowing (23 %), followed by others (16 %), moving (9.1 %), and medical (7.8 %).

Advantages and disadvantages of online loan

Merits of online loan

The benefits and disadvantages of microcredit are the same in each case. Advantages of this tool:

- High speed of decision-making - banks reduce the processing time of online loan applications, but the waiting time remains long. People don’t like to wait long, so IFIs products remain in demand, programs check potential borrowers for 5-10 minutes. From the moment of receiving the questionnaire for a cash loan;

- Instantaneous receipt of money - the review of the questionnaire may be prolonged if additional documents are required, but the payment after approval is done without delay. The amount will be instantaneous on your electronic account or bank card. In rare cases, the deposit may take up to 3 days;

- Application from any place - the Internet simplifies life, makes it easier and quicker to apply online, filling in the questionnaire will take no more than 5 minutes. The only access to the Internet is required, and the application is possible through a PC, tablet, or smartphone;

- Transparency of terms - the cost of the IFIs loan is immediately specified. The client enters on the site the number of funds he wishes to receive, indicates the term of use, and immediately sees the amount of overpayment. Then you decide to accept or not the loan;

- The possibility of issuing money to a client with a damaged credit history - during a crisis, banks tighten the selection of borrowers and issue loans only to regular customers. Many are denied funding. MFIs willingly give instant cash loans online to customers with bad credit history, embedding the risk of non-repayment in interest on the loan.

What is good about online loans?

Using micro-loans, IFIs clients may:

- To become a reliable borrower by correcting bad credit history - the receipt and repayment of multiple loans increases the chances of getting a large amount in the bank, as the borrower’s reputation will be corrected;

- To obtain quick cash loans by submitting only a national identity card- the IND, income certificates, or other documents doesn't need to make the loan;

- Not to bother with filling in the long-form - when borrowing money from IFIs, a simple form is drawn up, the completion of which will take up to 5 minutes. The customer merely indicates his contact information, national identity card data, employment information, income;

- To obtain a loan without collateral or surety - the money is approved without any additional requirements;

- Pay only interest on the use of microcredit - no additional commission;

- Repay the loan in a single amount at the end of the term or earlier. If interest is charged on the loan, the amount must be refunded with interest.

Disadvantages of an online loan.

The weaknesses of this tool include:

- Hundreds of interest rates are calculated for a loan term of up to 30 days. The average duration of microcredit is 14 days. In arranging a loan, one should look at the annual rate and the final amount of overpayment;

- A small loan amount - the maximum amount of microcredit in IFIs rarely exceeds Rs. 50,000 and then it is available only when it is reused. Microcredit addresses small and urgent needs;

- Short term - usually up to 30 days, less often extended to 4 months.

Before taking out a mobile online loan, you need to assess the pros and cons of the product, weigh all the factors to make microcredit effective. If offers from IFIs did not benefit users, they would not be in high demand in the consumer market.

What consumers need to know about online loan

Convenience is good, but consumers need to know what they get. It is recommended to ask the following questions before signing the agreement:

What is the product and what are the conditions?

- Many companies offer loans for installments that have fixed rates and payback periods. Each type has certain legal rights for consumers.

- Loans - banks and entrepreneurs treat collateral differently. The bank insists on its valuation of the property and wants to control it for as long as it is in collateral. The bank needs to see that the collateral is managed correctly, that no attempt is made to sell or lease it and that it is maintained and does not lose value. Businessmen have the opposite attitude to the pledge: they want the property to «work» and bring the maximum benefit, with the time wanting to speed up the loans. This option may cause some conflict, but it can be resolved.

- Every time you apply for a loan, your credit information is updated and the loan appears in your credit report.

- To prevent anyone from using your data to obtain credit online, store it in a secure location. Do not disclose to outsiders the validity of the card, CVV code, set reliable mobile banking passwords. If documents and/or bank cards are lost, please contact the appropriate authorities immediately for their replacement.

- Also, check the dispute resolution process if you misunderstood something or have other problems to get the salary loan, repayment, or refund (cancellation).

Online lending is gaining ground in Sri Lanka. In situations where the money is needed here and now, this is one of the best ways to solve the problem with maximum speed and maximum self-benefit using OnCredit loan calculator. With the help of access to the worldwide network, the necessary amount can be obtained from anywhere in the country.

Even though the reasons differ from one country to another, mainly people choose to obtain credit on the Internet for three purposes, namely:

- billing. Internet credit can help to avoid debt related to payment of bills such as electricity, water, or waste, but it must be borne in mind that this option of payment of bills, Is likely to be a one-time rule and cannot be considered a daily norm;

- contingency. In the event of a sudden breakdown of an important appliance, it is often necessary to make a loan because, for example, if water pipes are broken, it is not possible to wait for the next salary;

- purchase of goods. There are situations in which additional funds are necessary, such as the purchase of essential medicines or preparation for school.

But if you’re thinking about getting credit on the Internet, the most important thing is to assess the situation. OnCredit’s convenient lender calls: Before using a bank or non-bank lenders, assess the possibility to repay the loan within the agreed term using OnCredit loan calculator.

Since microcredit is granted for a short period, it is generally assumed that the interest rate is higher than for a cash lending bank. But this is not always the case in practice.

Some organizations bet high percentages on their offers. But it’s not all IFIs, and it’s not all IFIs. Some organizations generally lend to their new customers at 0-0.2%, which is much more profitable than cash lending at the bank.

The main risk of microcredit is precisely high-interest rates. But if you choose the loan wisely and compare the offers from various institutions on our site OnCredit, you can avoid overpayment and process the loan not only quickly but profitably.

Microcredit is low-interest loans of 30,000 rupees up to 50,000 rupees, the address of which existing micro-enterprises and the unemployed, who want to realize their business - an idea. They are usually issued by banks without collateral and guarantees are provided by specialized government bodies. Microcredit is accompanied by business development services (training, mentoring, coaching, consulting, accounting, and legal support) to ensure continuous and close communication between the lender and the borrower. The amount of credit can be used for both working capital and investment costs.

OnCredit offers attractive microloans for your personal needs (holidays, travel, daily needs). OnCredit, the most reliable alternative source for individuals and companies, offers EVERYONE -40%, CODE: YT2CF, as well as a comprehensive and flexible personalised lending scheme that provides solutions to meet your own and/or emerging needs of your family.

- Family expenses

- Leave expenses

- The cost of renovating or renovating your home

- Wedding expenses

- These personal loans can also be used to repay existing small loans or even to better plan and reduce monthly payments

In other words, you can now easily and simply obtain loans and cash through time-consuming and painstaking procedures.

Why should you issue an online loan through the Internet?

- Application for credit from any place at any time of the day

- Saving time to travel to and from the bank’s branch and waiting in queues

- There’s no risk of someone stealing your money because you won’t have to walk around with a lot of cash

To collect the money for any purpose, and it has been credited to a bank account, it is necessary only to fill in the online loan application in OnCredit.

After a company checks your online loan application (up to 15 minutes) and you pass the approval, you will be able to borrow money online for any needs: money before salary, credit for repairs, credit for the purchase of equipment, credit for education, or consumer credit for any personal needs.

There are almost no restrictions on borrowing money. To obtain a credit card, the borrower must be a Sri Lankan citizen, have a national identification card, , and an active bank account. They may be students, pensioners, unemployed persons, persons without formal employment or income certificate, without guarantors, or with a relatively poor credit history.

IFIs loan terms: loans (credits) are usually granted for up to 30 days, interest is charged daily and the amount of the first loan is up to 3.5 (sometimes 5) thousand rupees.

In simple and flexible ways, OnCredit offers attractive microloans, which you can use for holidays, wedding expenses, for your home and emerging needs, as well as for other daily contingencies.

What is the right thing to do before taking an online loan

Online loans are great for covering urgent and emergency situations. It is important that you understand the responsibility of using the funds. Tips to keep in mind:

- Start by choosing a loan company. Research reviews, company pages on social media

- Make sure you understand all the terms and conditions before signing the agreement.

- Before taking out a loan, make sure you can meet all the repayment terms.

- Be sure to pay the loan in full on time, as late payments may result in unexpected costs such as additional fees or higher interest rates.

- You should clearly understand how you will repay the entire amount of the loan.

- If you have the option of early repayment of the loan, if you need to take advantage of it.

Use these tips to safely cover any emergencies that arise.

How OnCredit Works

OnCredit offers

- Cash credits for any requirements

- Credit without collateral and guarantors, only with passport and identification number, without leaving the house

- Lack of additional hidden commissions, payments, insurance, and first contributions

Requirements on borrower

- Original national identification card

- Regular labor income

- Age of borrower 20-55

Process of obtaining credit

- The client completes the loan application within 5 minutes

- After which he receives a call from our employee, is checked, and provides a scanned copy of the documents (NIC) and his account number for which he wishes to receive a loan

- Within 3 minutes receives a loan decision

- In the event of a favorable decision, the credit is immediately on the account of any bank selected by the client

- The process of obtaining a loan takes less than 3 minutes if re-applied

| New loan | Repeat loan |

| Term: 5 day | Term: 10-30 day |

| Amount: 2K-50K | Amount: 20K-100K |

| Interest rate: 0% | Interest rate: 1,73% |

Amount and cost of credit

- OnCredit provides loans of up to 6,000 rupees on first use

- The price of the loan depends on the amount of the loan and the period of its use

- The term of use of the credit may be extended by payment of the payment for the use of the credit.

- In the case of early repayment, credit charges are remitted interest rate

- An example of the calculation by the loan calculator at the rate of 2%: with a loan of Rs. 3,500, the fee for using the funds will be 70 rupees per day, which is about 2% per day. APR - 730%. The company does not accept any additional fees for the use of the loan.

- Liability that the Borrower may incur in the event of default on obligations to the partner.

- A debt-enforcement process may be initiated or claims may be transferred to third parties;

- The interest of 2 % on the use of borrowed funds is charged for each day of use of the borrowed part of the loan amount up to and including the date of actual repayment of the entire amount of the loan;

- For 3, 8, 13, 18 day of delay, a penalty is charged with a percentage of the outstanding loan amount.