Repeat loan with profit! Use promo code S109 and get a -35% discount on your next loan. Apply now and save money with us!

Many people have the opportunity to get credit funds and use them for their needs. All you have to do is enter a request in the search box and look through the list of options. The Lotus loan stands out among the offers in a special way. Simple conditions, easy application and access to the service online will allow you to get the funds, which will come to your account in a few minutes.

Lotus loan company offers its services to residents of Sri Lanka. In order to get a loan, you need to make sure that you meet the basic requirements, namely:

- have reached the required age (22 to 55 years old);

- have obtained Sri Lankan citizenship;

- your monthly income is 25,000 rupees.

The request form includes the provision of information. You need to specify your passport data and prepare the required documents to confirm the information.

What you need to do before you apply for a loan from Lotus loan

Hard times can be very draining, but a Lotus loan can give you some cash. However, there are a few things to keep in mind:

- Research reviews on app shops as well as social media pages.

- Make sure you understand all the terms and conditions before you sign the contract.

- Make sure that you will be able to meet all the payments before taking the loan.

- You must repay the loan immediately on the due date, as late payments will incur additional charges or higher interest rates.

- It is important that you fully understand how the entire loan amount will be repaid.

- If your loan has an early repayment option, take advantage of it if necessary.

Stick to these guidelines to ensure that you can safely handle any financial difficulties.

Peculiarities of providing credit services

The maximum loan amount is 40,000 rupees. Applying for Lotus loan, it is possible to pass the check quickly and find out the decision on acceptance (rejection) of the issued request. It is recommended to pay attention to the terms and conditions that relate not only to the receipt of loan funds, but also to the loan repayment.

The basic requirements are posted on the website, and the list includes:

- the term for which the first loan is granted: 122 days;

- the established interest rate: 12% per annum;

- maintenance fee: 13,920 rupees.

You can get additional terms during the consultation or on the official Lotus loan website.

|

Maximum amount |

40,000 rupees |

|

Maximum term |

122 days (4 months) |

|

Interest rate |

12% per annum |

Repeated Loan Terms and Conditions

Loans to Sri Lankan citizens for repeated applications are subject to different terms and conditions. Lotus loan customers who want to get credit funds for the second time enjoy some privileges:

- the maximum term is increased to 182 days;

- the consultation fee is 3,600 rupees;

- NIC documents must be submitted to process the request.

By familiarizing yourself with the terms and conditions of the online loan in advance, you can choose the offer that best suits your interests.

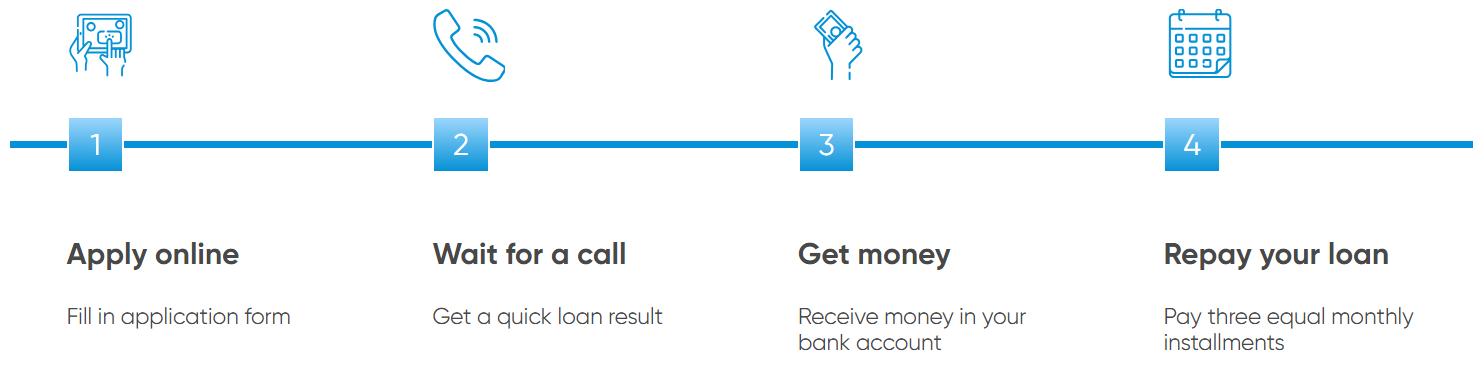

How to apply for a loan

Lotus loan offers easy terms for applying for a loan. You do not have to look for a branch in your city or wait a long time for a decision. The registration procedure is as follows:

- opening a registration form on the website;

- filling out a form with the amount of the loan and applying for it;

- obtaining consultation from a Lotus loan officer by phone;

- online confirmation of the specified information;

- receipt of funds to the specified bank account.

It is important to note: repayment of the loan is made by making payments according to the details, which are available after the Lotus loan organization's approval. Payment is made by three transfers, the amount of which is set in advance. All in all, you will need to make three payments to cover the debt.

Obligatory terms and requirements to the borrower

Loan financing through Lotus loan system is available on favorable terms. Clients not only receive credit funds to their account, but also enjoy several advantages of cooperation with the company:

- there is no first payment;

- loan request is processed online;

- it is enough to provide electronic documents.

It won't take you more than 5 minutes to fill out a request. Funds are credited to the specified bank account within 24 hours of receipt of a manager's confirmation or by any other method. You can also request an early repayment. The amount of the first and subsequent payments should not be below the established minimum, but can exceed it.

Requirements for customers

Lotus loan customers receive loans of 40,000 rupees. The repayment period is up to 4 months. To take advantage of Lotus loan services, the following requirements need to be met:

- provide an electronic document for proof of identity (NIC);

- availability of a permanent place of employment;

- age requirement (22-55 years old).

Obtaining a Lotus loan Sri Lanka online allows you to review the details of the loan agreement and reject the offer. If conditions and requirements meet your expectations, the borrowed funds will be credited to your bank account within 24 hours. Lotus loan system notifies you by sending a message to the phone number indicated in the application form.

Pros and cons of using the system

Lotus loan company offers to get loans to Sri Lankan citizens on favorable terms. The reasons to accept the lender's offer include:

- the possibility of obtaining loans within 1 day;

- simple and transparent payment terms;

- application process takes no more than 5 minutes;

- there is no collateral requirement; the request is made online;

- documents are provided in electronic form.

Lotus loan Sri Lanka's decision to give out loan funds is made by phone, so you don't have to go to a bank branch. The Lotus loan website provides detailed information about the terms, requirements and payment options. Early repayment is also provided, so customers decide for themselves when they can repay the borrowed funds. The transparent work of Lotus loan attracts attention, but it is necessary not to forget about the existing disadvantages. Some of the cons of cooperation include:

- lack of ability to use mobile apps to make an application or repay debts;

- the company charges additional fees for consultations;

- information on the consequences in case of missing a scheduled payment is provided by the consultant.

Lotus loan Sri Lanka's offer is evaluated when all necessary information is available. The company does not hide the presence of additional fees, which means it is a reliable lender for Sri Lankan residents.