Repeat loan with profit! Use promo code S108 and get a -35% discount on your next loan. Apply now and save money with us!

If you need money fast, but your relatives cannot lend it to you, look for online loan services in Sri Lanka that can help you solve the problem quickly and efficiently. LoanMe Sri Lanka is a proven provider of such services that you can rely on.

What you need to do before you apply for a loan from Loanme

In times of financial hardship, you can borrow money from Loanme. However, there are some points to keep in mind:

- Check reviews about the company, for example on the app pages in G Play or App Store

- Don't sign a contract without familiarising yourself with all the terms and conditions.

- Before taking out a loan, make sure that all repayment terms can be met.

- Failure to pay on time incurs hidden costs such as additional fees or higher interest rates, so make sure you repay the loan in full on the due date.

- You should know exactly how to repay the full amount.

- If early repayment is available to you when you borrow the funds, apply for it if necessary.

Use these tips to protect yourself in case of financial emergencies.

LoanMe loan

Before applying for a loan on the Internet, read the terms of cooperation with the company. The loanme.lk website has all the information you need to familiarize yourself and apply.

The company operates under the laws of Sri Lanka and is a trademark of the Fintech Software Solutions (Private) Limited.

The basic terms of cooperation include:

- applicant’s age should be 22-55 years old;

- borrower must be employed; the maximum loan amount is 40000 Rs,

- the minimum is 5000 Rs;

- loan period can be up to 120 days;

- applicants must have a bank account.

Check all the requirements carefully before signing the agreement.

How can I apply for a money loan?

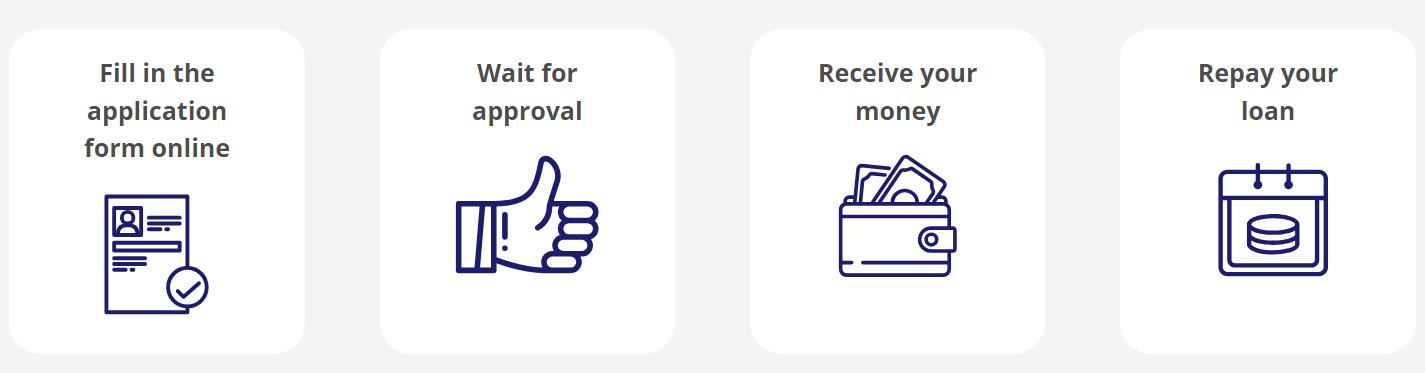

When you need money, it’s often a problem to find it quickly. First, you should ask your friends and relatives to lend you some amount, but if it’s impossible to get a loan from close people, you can loan online safely with LoanMe Sri Lanka. Short-term credits are designed to quickly solve unexpected financial problems. Therefore, it’s important to follow the following steps:

- Choose a trusted service provider. This is an important point, so approach it responsibly. LoanMe will become your reliable partner in any difficult financial situation.

- Read carefully the terms of cooperation. Perhaps the service doesn’t suit you according to some criteria.

- Fill out an online application for a loan, providing the correct personal data.

- Wait for a response from the service within a few minutes.

- The main condition is to return the borrowed money on time so that you can cooperate with the company in the future.

How to fill in the application form?

Everything is very clear and simply described on the LoanMe Sri Lanka website:

- enter your first name, last name and phone number;

- take a selfie;

- provide your NIC photo;

- submit your application and wait for a response from the company;

- as a rule, refusals or approvals come within 5-20 minutes;

- sometimes, support staff may call you back to clarify some details or verify your data.

If everything is fine, you’ll receive the money within 24 hours after your application is confirmed. If you have not received an SMS notification, please contact customer service.

You will receive the money in the bank account you have specified. This is convenient because you don’t need to go somewhere and stand in long lines.

LoanMe terms and conditions

|

Period of loan |

3-6-12 months |

|

Money loan |

Rs 5000-40000 |

|

Interest rate |

⁓15% |

The commission amount may vary, so be sure to check it every time you take a loan.

What happens if I can’t pay my debt on time?

Before taking out a online loan, think carefully about whether you can repay it on time. Would it be a good decision to borrow money from online lenders? After all, their interest rate is quite high, and the repayment periods can be short.When you take out a loan, you are obligated to repay it on time. If you are unable to do this, you may experience the following problems:

- penalties;

- higher interest rates;

- your loan may be sold to collection companies which will harass you and demand significantly more than you originally owed;

- your credit history will be ruined, and other companies will not want to cooperate with you.

Therefore, soberly assess your financial capabilities before applying for a loan.

How to repay the loan?

To pay off your loan correctly, follow these steps:

- log into your bank account;

- select “transfer”;

- LoanMe transfer;

- Enter the amount you plan to pay;

- Enter your agreement number;

- Check if everything you entered is correct; carry out the transaction.

This step-by-step instruction will help you do everything quickly and without errors.

Pros and cons of cooperation with LoanMe

You can find both positive and negative sides of cooperation with LoanMe loan service.

Advantages:

- you can borrow money online without leaving your home;

- your application will be reviewed within 5-20 minutes;

- money comes to your account in 1 day;

- repayment term can be 3, 6 and even 12 months.

The disadvantages aren’t numerous and boil down to a few points:

- quite high commission rate;

- floating interest rate;

- need to be employed in order to receive a loan.

Weight all pros and cons before applying for a loan with this company.

Customer Reviews about LoanMe Sri Lanka

Users rate the service at a fairly high level. The company is proven and delivers quality services to Sri Lankans who find themselves in difficult life circumstances.

Therefore, you can resort to the help of LoanMe when you need money quickly.

In what cases should I not use the services of online lenders?

If you don’t want to get more serious expenses, evaluate your possibilities. You should not contact online lenders if:

- your expenses exceed your salary;

- you have no savings;

- you want to make a spontaneous spending of money.

To avoid using a loan service, you need to develop the following habits:

- live within your means (understand your spendings and income) save money;

- invest in your future life; build up your assets;

- organize your paying bills; improve your financial education;

- set realistic goals.

Don’t make purchases that you cannot afford. You must schedule your expenses without exceeding the settled limits.