Repeat loan with profit! Use promo code S109 and get a -35% discount on your next loan. Apply now and save money with us!

Fast Rupee is a fairly new project that provides loans to Sri Lankans who need fast money. This is a completely online service that helps people who are not given credit by banks. So if you are in dire need of money, you can use this lending service.

What you need to do before you apply for a loan from Fastrupee

Taking out a loan from Fastrupee can help you in a financial emergency. But before you take out a loan, remember this:

- Research publications, firm’s pages on social media

- Make sure you read and comprehend all the terms and conditions before signing any agreement.

- Before applying for a loan, check whether you can comply with all the repayment requirements.

- Ensure that you clear the loan within the set deadline as failure to do so will attract extra charges such as additional fees or increased interest rates.

- You should be well aware of how you will pay off the whole sum of money borrowed.

- If there is an opportunity to return your debt earlier than it was originally planned, what would you do?

Apply these hints in order to safely handle any financial emergencies you may face.

Fast Rupee Sri Lanka

This company provides the fastest money loan services. The terms of cooperation with it are:

- the borrower’s age should be 20-80 years;

- citizenship: Sri Lanka only;

- the borrower must have income;

- the first loan is 10,000 LKR, the next ones are up to 50000 LKR;

- loan term: 3 or 6 months;

- the interest rate is thirty percent per month.

A sufficiently high percentage of interest makes you wonder whether it’s worth borrowing money for immediate wishes. Only real need can be a precondition for borrowing money from the lenders.

How to calculate Fastrupee Sri Lanka interest rate?

To find out exactly how much you will have to pay commissions, use the calculator on the fastrupee.lk website. When entering the amount you plan to borrow in the left box, in the right one you’ll see the payout amount with the interest of the company.

Here are some examples:

|

Loan amount |

Repay amount |

|

LKR 1,000 |

LKR 1,180 |

|

LKR 5,000 |

LKR 5,900 |

|

LKR 10,000 |

LKR 11,800 |

How to apply?

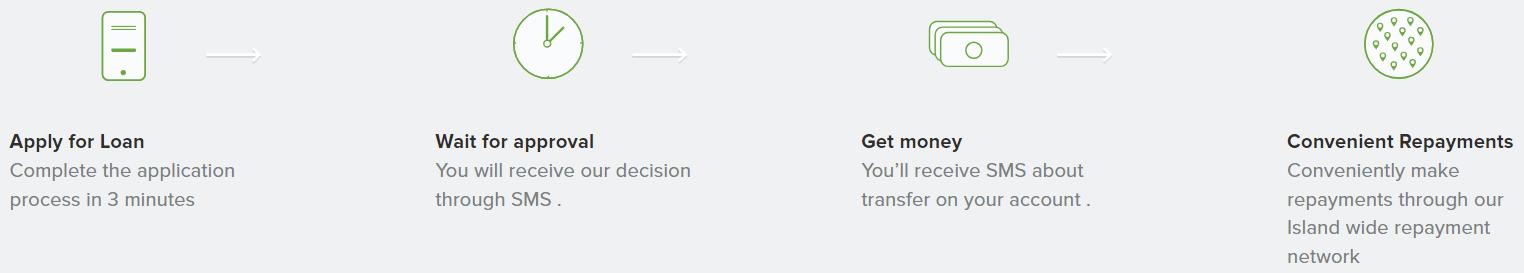

Fast Rupee is a fast and convenient solution for all your financial needs. The entire loan process can take 10-30 minutes. All you have to do is:

- go to the official website of the FastRupee service;

- choose the amount and period of the loan;

- fill in the questionnaire in which specify your full name and telephone number;

- confirm your request and wait a few minutes;

- you will receive an SMS notification with the status of your application;

- if all is well, you will quickly receive money in your account.

If for some reason the lender refuses you, contact the support service for more details.

What consequences can await me if I don’t repay the loan on time?

When you borrow money, you commit to repay it in full within the specified time frame. If you are unable to repay the loan on time, you can expect the following troubles:

- Fines and penalties.

- Higher interest rate.

- The FastRupee can sell your agreement to collection companies so that they force you to return money using more stringent methods: 24/7 calls, threats.

- Your credit score will be spoiled and you won’t be able to borrow from other lenders.

Before applying for a loan, make sure that you can repay it in full.

Ways to repay a loan with Fast Rupee

You can pay off your debt in several ways:

- via bank transfer;

- Pay&Go Kiosks service (just choose the Fast Rupee, add your contact number and pay money);

- Sampath Bank transfer (fill in bank deposit slip with your personal data and the FastRupee’s, enter your contract number , NIC and the amount you want to pay. Don’t forget to keep the payment receipt till the SMS notification from the loan service comes);

- NDB Bank transfer looks similar to Sampath Bank

- A large selection of replenishment methods allows you to choose the most suitable for you. It is convenient and time-saving.

How can I contact Fast Rupee support?

Customer support service is available through the following channels:

- social networks (Viber, WhatsApp);

- phone number;

- email.

When you write on email, the answer usually comes within 1-2 business days.

Advantages and disadvantages of using Fast Rupee service

When you are looking for a money loan service, pay attention to customer reviews. According to feedback, the FastRupee has the following advantages:

- this is the fastest loan service in Sri Lanka;

- for the first loan, the interest rate is only 0.01%;

- increasing the loan amount with every subsequent application.

Company’s weaknesses:

- high interest rates;

- large fines in case of late repayment of the debt;

- it’s necessary to indicate sources of income when applying for a loan.

To avoid unpleasant surprises, read the terms of cooperation before signing the agreement with the company.

Are online loans dangerous?

Yes, the loans with online lenders can be dangerous and have unpleasant consequences. Why? Because the lenders are people interested in making money. On the one hand, their requirements are democratic and attractive, and on the other hand, they earn on you by:

- setting high rates;

- introducing additional fees;

- fining those who are in arrears.

When applying for a loan online, read carefully all the terms of use and decide for yourself whether you are able to repay the loan on time. In any case, avoiding borrowing money is always a good decision.