Repeat loan with profit! Use promo code S109 and get a -35% discount on your next loan. Apply now and save money with us!

Today, many financial operations can be carried out online, including borrowing money. Familiarize yourself with the services offered, choose the most suitable and submit an application. As a rule, money is credited to your account very quickly, which is convenient and allows you to make some kind of purchase or solve a financial problem in a short time.

What you need to do before you apply for a loan from CashX

CashX can help you out of a difficult financial situation. However, there are a few things to keep in mind when doing so:

- Firstly, check reviews in the app shops and the company's Facebook page or other social media accounts.

- Secondly, make sure you clearly read all the terms and conditions before signing the contract.

- Third, make sure you make all the payments stipulated in the loan agreement.

- Finally, remember that the loan must be paid back on time, as late payments will incur additional fees or higher interest rates.

- In addition, it is important to understand how the entire loan amount will be repaid.

- In such cases, it will be a good idea if you take advantage of the early repayment option of the loan.

With all these factors in mind, you will be able to handle any financial situation without putting yourself at great risk.

CashX loan

Before submitting an application on the cashx.lk website, read carefully the terms of use of the service. The conditions may not suit you or you may not meet the requirements of the borrower.

The main terms of cooperation include the following points:

- Applicant’s age should be 20-60 years;

- the maximum loan amount is 50000 rupees, the minimum – 5000 Rs;

- loan term is 10-30 days;

- nationality: Sri Lanka.

These simple requirements won’t become a big limitation when you need money fast. Therefore, the CashX Sri Lanka service is a good option for those who are in financial trouble.

Features of CashX loan

CashX is a fairly new but proven lending service provider that operates in Sri Lanka. You can receive money while in any of these cities:

- Vavuniya;

- Matale;

- Ratnapura;

- Kotte;

- Dehiwala;

- Colombo;

- Kandy, etc.

Read the full list on CashX’s official website.

The company operates under the license of Green Money Tree Lending Corp and issues microloans at an interest percentage of 15-18%.

For example:

|

Money loan |

Rs 10,000 |

|

Period of CashX loan |

10 days |

|

You have to repay |

Rs. 11500 |

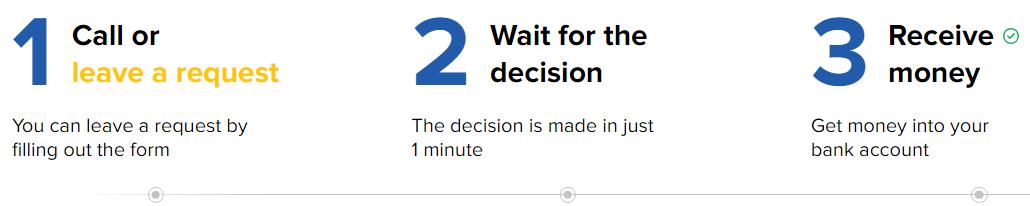

How can you apply for a loan on CashX?

Before submitting the application on the CashX loan website, think about whether you really need the money. Since the interest rate of the borrower is quite high, you need to weigh all pros and cons. It is better to borrow money from friends or relatives, but if there are no other options, welcome to the official website of CashX Sri Lanka, where you can loan the necessary amount quickly and without any problems.

To apply for the loan online, you should make such steps:

Register on the site.

-

Provide your ID and phone number.

-

Sign the CashX contract online.

-

Pass verification process.

-

Get money on your account.

This process will not take you much time. Money will come to your card within 15-20 minutes.

How to calculate the payout percentage on CashX?

It’s easy to do this: there is a special calculator on the site, where you can enter the loan amount (from 5000 to 50000 Rs). The CashX calculator will do all the calculations for you. Don’t forget to indicate the term for which you take the money. It can be from 10 to 30 days.

How long do you have to wait for a response from the system?

CashX is an automatic service, so you won’t have to wait too long for a response. On average, it takes 2-3 minutes. Sometimes, customers receive calls. Thus, the support service verifies documents or clarifies some details. Documents you need to submit to CashX:

- your ID;

- your valid telephone number;

- your personal information.

Be sure to check if everything is correctly indicated so that there are no problems.

How to get money from CashX Sri Lanka?

If everything goes well with your application, you can receive money within 20 minutes on any type of account that you specify.

If CashX doesn’t accept your application, please try again. You may have made a mistake in your data.

If the loan is still not confirmed, contact another service in Sri Lanka.

How can I repay the loan in CashX Sri Lanka?

You can repay the loan in any way convenient for you:

-

log into your CashX account.

-

choose the desired operation from the menu;

-

repay the loan or just extend the contract;

-

in case of renewal. You need to pay the CashX fee.

The refund options include:

- bank cards;

- repayment service Pay&Go Kiosk;

- cash payments;

- bank transfers (Sampath Bank, Cargills Bank, Internet Bank, etc.)

How does the Pay&Go Kiosk work?

You can repay your loan with the help of this service. Choose:

- finance category;

- CashX;

- your NIC;

- your telephone number;

- the sum you want to repay;

- enter cash;

- complete the operation;

- take the check and make photo;

- send the photo to the number 0775397150 (viber/whatsapp/facebook);

- wait until your payment is updated.

Does CashX Sri Lanka have a mobile version?

Yes, it does. Look for the CashX application in your app store. It’s supported by both iOS and Android operational systems.

Does CashX Sri Lanka have a social networks account?

Yes, it does. Look for the CashX page on Facebook, YouTube and Linkedin.

What are the advantages of cooperation with CashX loans?

If you choose CashX Sri Lanka, you’ll have such benefits:

- proven company with legal operation in Sri Lanka;

- confidentiality and protection of your personal data;

- you can have any credit history; fast approval;

- all you need to fulfill is your ID and phone number;

- you can prolong the credit; you don’t need to go anywhere, all transactions are made online;

- CashX is a reliable partner when you’re in trouble; It’s an international company, so you can rely on it;

- You can improve your credit history if you repay in time.

These advantages are based on user’s feedback, so you can be sure of the confidence and legality of CashX service.

Drawbacks of CashX service

Despite the numerous pros, there are some cons that should be taken into account when you’re looking for a money loan. They are:

- Short period for repay;

- Large penalties if you can’t repay the loan in time;

- High interest percent.

So, weigh the pros and cons before applying to the CashX service for borrowing money.

Customer reviews about CashX

On the Internet you can find a lot of reviews from customers who have used the services of this loan company. If borrowing money from CashX is the only way out of an unpleasant life situation, use its services without any doubts. The main condition is to repay the loan on time. Then you can quickly solve the financial problem and not lose too much money on the service commission. In any case, cooperation with the company is an experience that will be pleasant and useful if you take into account all the requirements of the borrower.