Unless you’ve taken a deep dive into the world of banking and finance, there is a good chance you’re not that familiar with the term APR. Even though you might be somewhat well-versed with other financial terms and even though you might have even come across the concept, APR is not a widely-used term in Sri Lanka, unlike in other countries. APR is commonly found in conjunction with credit cards, vehicle leases, mortgages and other types of credit facilities. Many people who know APR to be the cost of borrowing money tend to confuse APR with the interest rate of a loan. However, APR and interest rates are not the same.

Let’s take a look at everything you need to know about APR and why it is important to be mindful about it.

What is APR?

.jpg)

APR is the commonly-known acronym for “Annual Percentage Rate” which is basically the total cost (as an annual percentage) incurred when someone borrows money i.e. also can be said the cost of a loan.

Too many people assume that the only cost of taking a loan or using a credit card is the interest rate applicable, which is incorrect. APR is a superior measurement of the cost of credit as APR not only takes into consideration the interest rate, but also the service charges, lender’s fees, and any and all other costs applicable, which makes APR the best way of comparing different credit facilities offered by lenders. APR will always be equal to or greater than the interest rate.

Why is APR important to me?

Comparing different lines of credit simply by their interest rates isi no longer feasible when calculating the cost of credit. Different lenders market their loans in various ways using a variety of gimmicks - credit card companies boast about monthly interests, some payday loan providers like OnCredit.lk use fixed rates and some credit facilities break down their annual interest rates into monthly values. This makes it very difficult for a layperson to compare just how much more expensive one type of loan is compared to another. Furthermore, even though one loan’s annual interest rate is apparently lower than another’s, the additional costs involved (late payment fees, annual fees, service charges etc.) could actually make it the more expensive option.

Simply put, APR is the best way of knowing which credit facility is the cheapest for the borrower, purely from a financial point of view.

How do I calculate the APR of a credit facility?

While in certain countries, regulation compels financial institutions to reveal the annual percentage rate (APR) of their credit facilities prior to signing any agreement, it is not so black and white in Sri Lanka.

The APR Formula

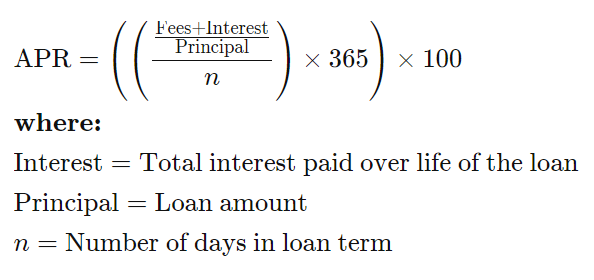

However, as a rule of thumb, APR can be calculated using the following formula:

Source: https://www.investopedia.com/terms/a/apr.asp

As seen in the above formula, APR makes it possible to compare various types of interest rates by bringing them all to one level e.g. daily interest rates, monthly interest rates, annual interest rates, flat fees etc. However, APR calculation is made a bit more complicated as lenders tend to apply and forego certain charges at their discretion which means that one credit facility can have different APRs for different customers. Therefore, it is important not to take another person’s APR calculations as the charges applicable for you might be different (for instance, the benefits offered to a person with excellent credit are far better than the limited options available for someone with poor credit)

Types of APR

APR varies not just across different types of credit facilities (e.g. loans, credit cards etc.) but also for each service offered within that credit facility, therefore the APR calculations must be done accordingly. Credit cards are a great example of how one credit facility can have different APRs.

Annual Percentage Rates of Credit Cards

When calculating the APRs of credit cards, it is important to know that different activities using your credit card tend to have different costs associated with it. For example, the cost of simply making purchases with your credit card will be different to the cost of withdrawing cash using your credit card (for which much higher service charges apply). Furthermore, balance transfers are priced differently and introductory offers need to be taken into consideration too (many credit card salespeople offer to waive off the first year’s annual fee).

Limitations of APR

While APR is a holistic way of calculating the annual cost of loans and borrowing money, it has many limitations. It isn’t always accurate and might predict a lower value than the actual cost incurred. APR calculation is also not recommended for floating interest loans.

When comparing various types of credit facilities, you simply can’t rely purely on interest rates. APR is a good indicator of the total cost, but again, it does not take into consideration other non-financial perks offered by lenders. While it is by no means a perfect tool, it provides a solid framework to use when selecting the cheapest credit facility for you.